Discover, Apply and Ease your education

Simplify your financial aid journey with Loan Ease. Our web-based platform provides students with easy access to valuable scholarships and loans. No more endless searches; find the perfect financial assistance with just a few clicks.

The Scope

This Project prompts a Web based native app fulfilling a B2B improvement opportunity, with 3 main features.

Time:

12 weeks

12 weeks

Role:

Project Manager and Lead Designer

Project Manager and Lead Designer

Features

Get Your Ease

Filter and search for loans, get all the information in one place

Loan/ Interest Calculator

Make informed decisions based on our interest calculator

Latest News

Get news and the latest information

UX Research Stage

A Little background:

LoanEase is a web based platform designed to make it easy for students to find valuable scholarships and loans. It simplifies the process by filtering the necessary information and helping you track your budget. This way, you can make well-informed decisions about your finances and improve your educational journey effortlessly.

Inspired by the challenges students face with complex and scattered information in education financing, LoanEase aims to create a user-friendly platform. The goal is to empower students by providing easy access to financial aid options, facilitating informed decisions, and reducing financial obstacles to education.

Inspired by the challenges students face with complex and scattered information in education financing, LoanEase aims to create a user-friendly platform. The goal is to empower students by providing easy access to financial aid options, facilitating informed decisions, and reducing financial obstacles to education.

Solution

Advanced search filters: Allow students to refine their search based on specific criteria like GPA, major, field of study, and financial need.

Personalized recommendations: Use AI algorithms to suggest scholarships and loans that best match a student’s profile.

Budget tracker: Help students create and manage budgets to understand their financial situation and track progress towards their goals.

Loan repayment calculator: Provide a tool to estimate monthly payments and total interest costs for different loan options.

Financial literacy resources: Offer educational content on topics like budgeting, saving, and debt management.

Student forums: Create a platform for students to connect, share experiences, and seek advice from peers.

Expert advice: Partner with financial advisors or counselors to offer personalized guidance and support.

Direct partnerships: Collaborate with colleges and universities to provide students with easy access to LoanEase and relevant financial aid information.

Integration with student portals: Integrate LoanEase into existing student portals for seamless access.

Personalized recommendations: Use AI algorithms to suggest scholarships and loans that best match a student’s profile.

Budget tracker: Help students create and manage budgets to understand their financial situation and track progress towards their goals.

Loan repayment calculator: Provide a tool to estimate monthly payments and total interest costs for different loan options.

Financial literacy resources: Offer educational content on topics like budgeting, saving, and debt management.

Student forums: Create a platform for students to connect, share experiences, and seek advice from peers.

Expert advice: Partner with financial advisors or counselors to offer personalized guidance and support.

Direct partnerships: Collaborate with colleges and universities to provide students with easy access to LoanEase and relevant financial aid information.

Integration with student portals: Integrate LoanEase into existing student portals for seamless access.

Opportunity

Target international students: Cater to the needs of international students seeking financial aid options.

Partner with high schools and guidance counselors: Promote LoanEase to high school students and their advisors.

Offer discounts or incentives: Provide special offers to attract new users and encourage referrals.

Career guidance: Integrate career counseling tools to help students make informed decisions about their educational paths and future earning potential.

Financial aid consulting: Offer premium services for students who require personalized financial aid consulting.

Debt management tools: Develop tools to help students manage and reduce their student loan debt.

Collaborate with financial institutions: Partner with banks and credit unions to offer co-branded products or services.

Work with student loan servicers: Integrate with student loan servicers to provide a more comprehensive financial aid platform.

Partner with high schools and guidance counselors: Promote LoanEase to high school students and their advisors.

Offer discounts or incentives: Provide special offers to attract new users and encourage referrals.

Career guidance: Integrate career counseling tools to help students make informed decisions about their educational paths and future earning potential.

Financial aid consulting: Offer premium services for students who require personalized financial aid consulting.

Debt management tools: Develop tools to help students manage and reduce their student loan debt.

Collaborate with financial institutions: Partner with banks and credit unions to offer co-branded products or services.

Work with student loan servicers: Integrate with student loan servicers to provide a more comprehensive financial aid platform.

Design Process

Competitive advantage

By offering a combined focus on scholarships and student loans with a user-centric approach, LoanEase can establish itself as the go-to platform for students navigating the complexities of education finance.

User Personas

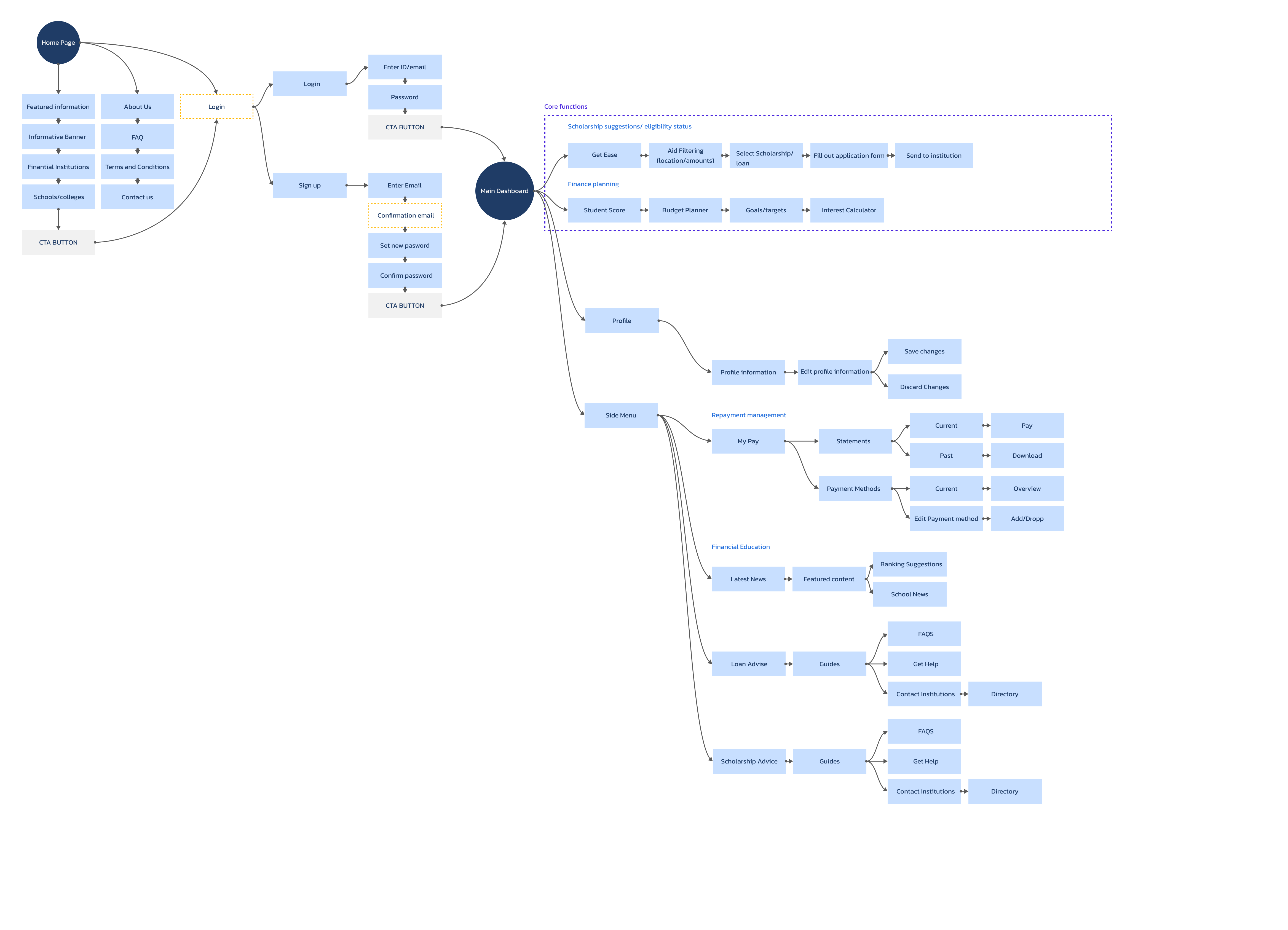

User flow

Our system prioritizes simplicity and intuitiveness. The central dashboard provides a comprehensive overview of core functionalities, ensuring a seamless user experience.

UI Design Stage

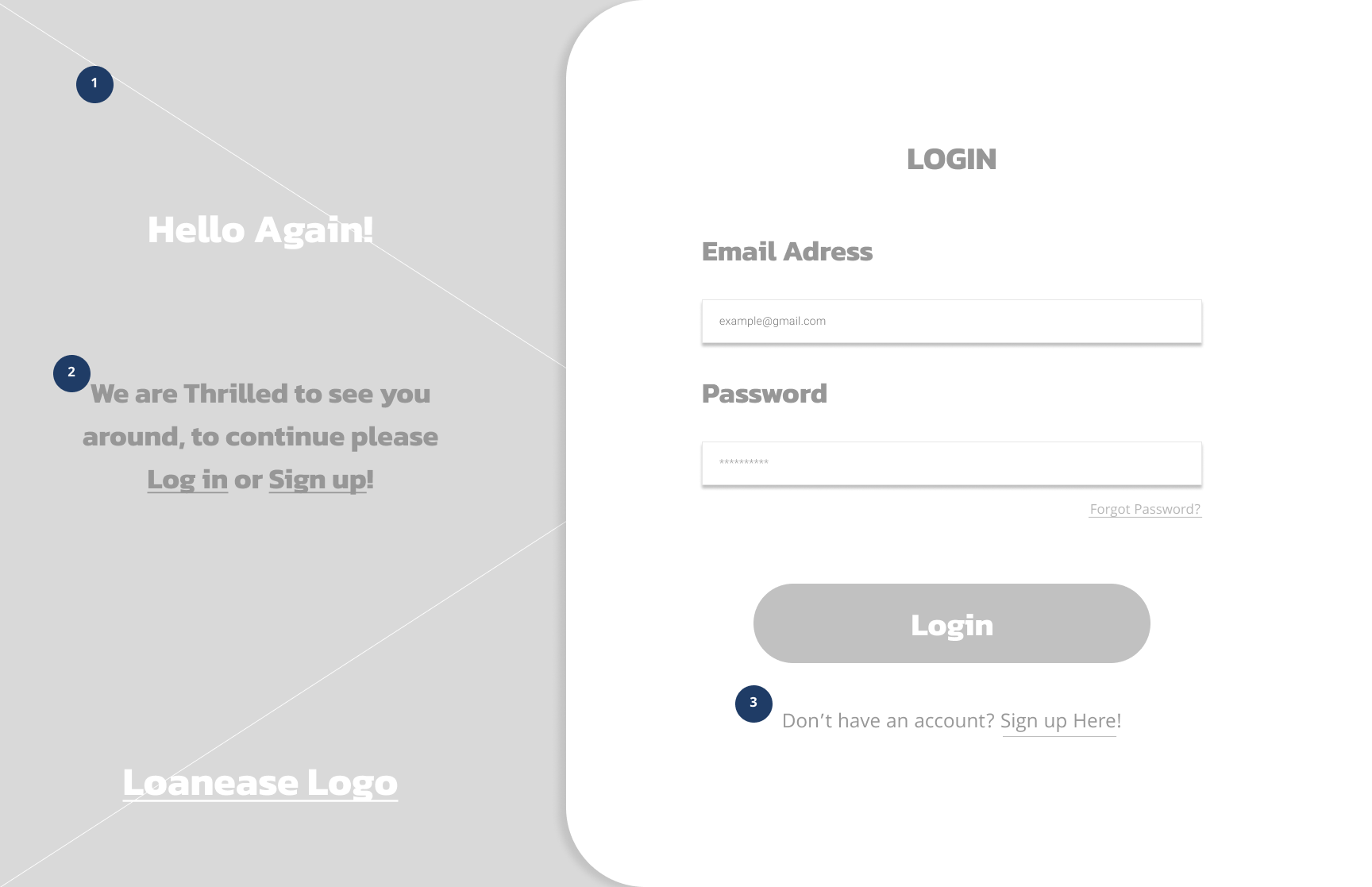

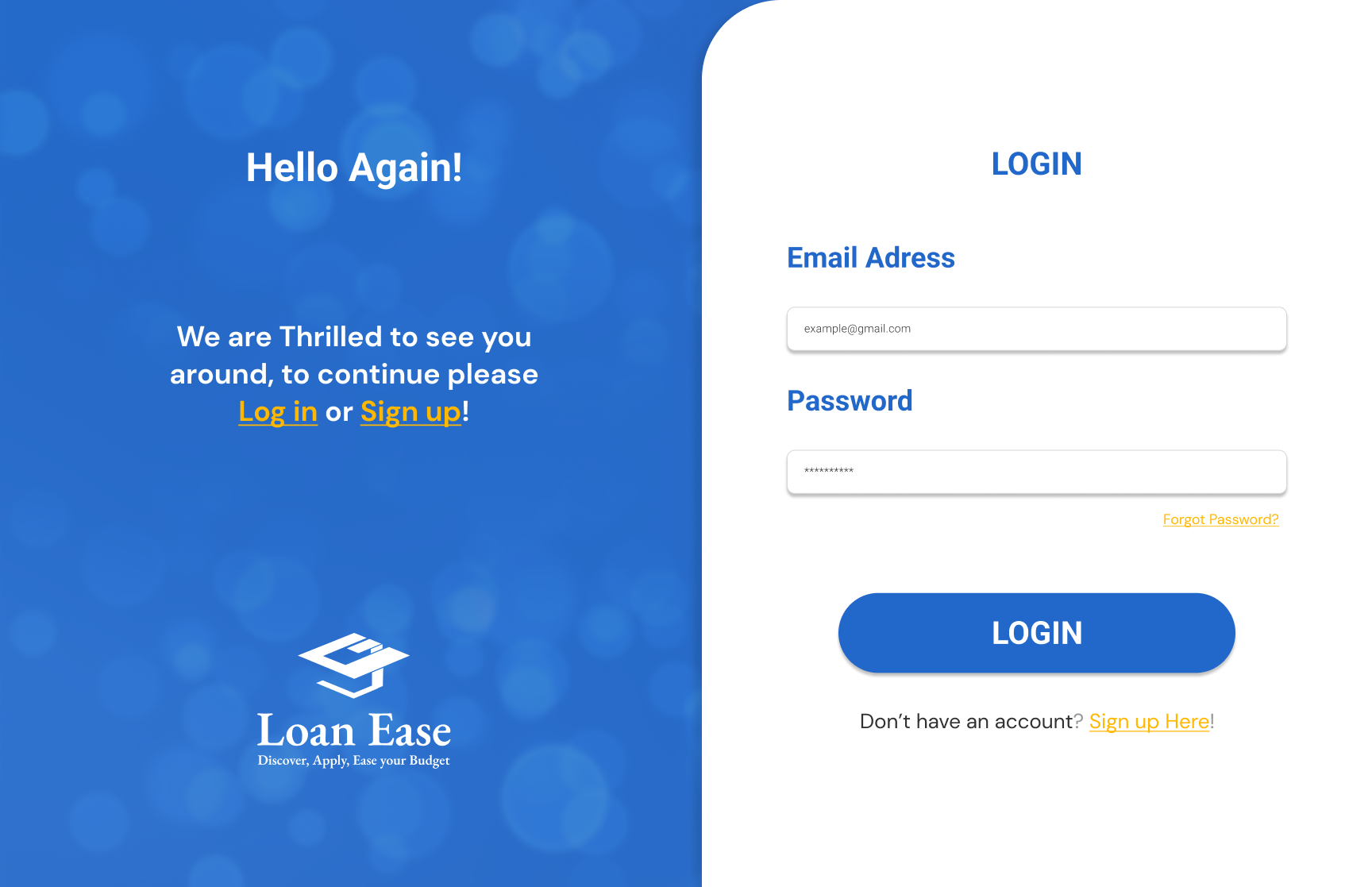

Wireframes vs Mockup

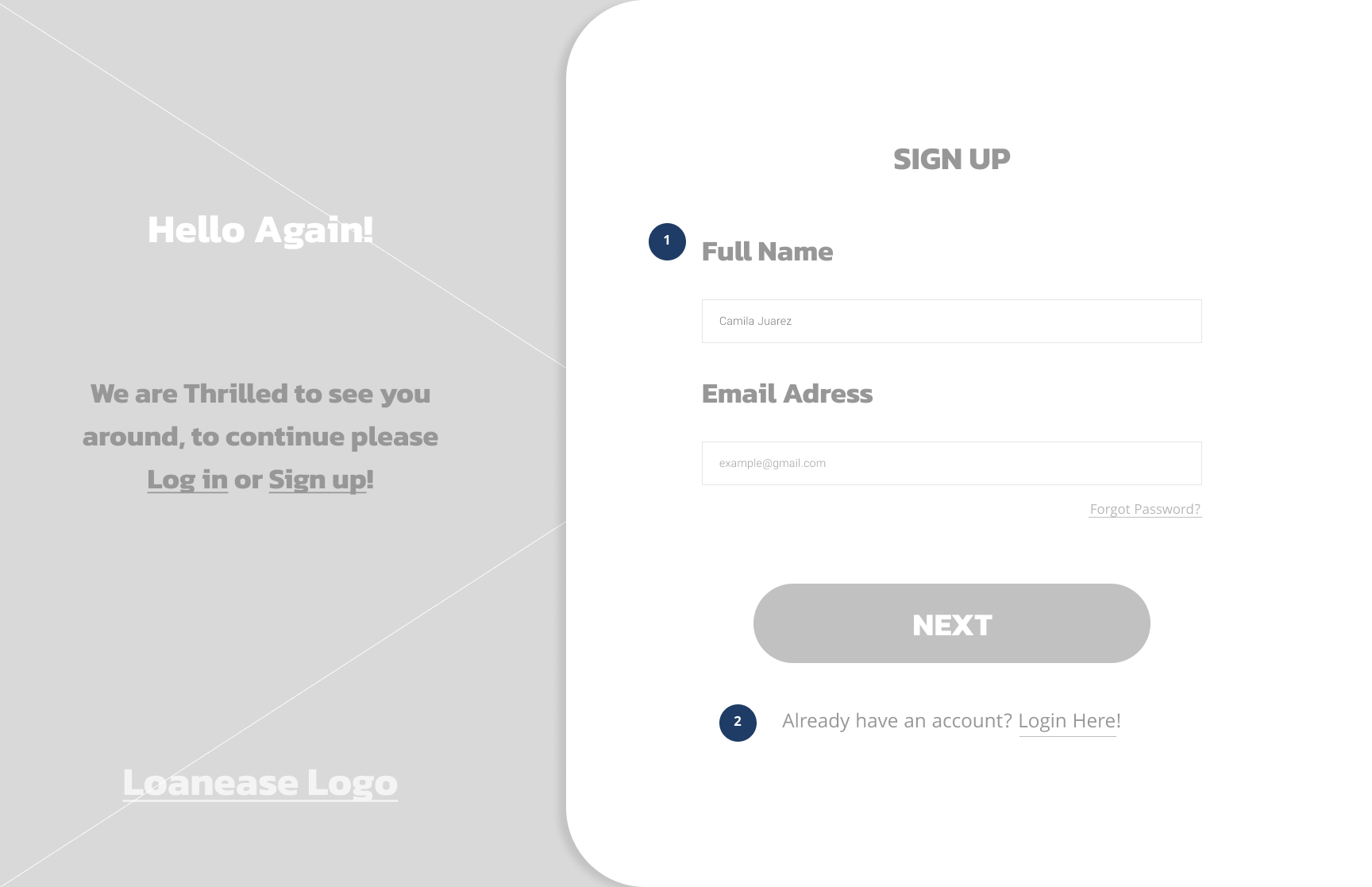

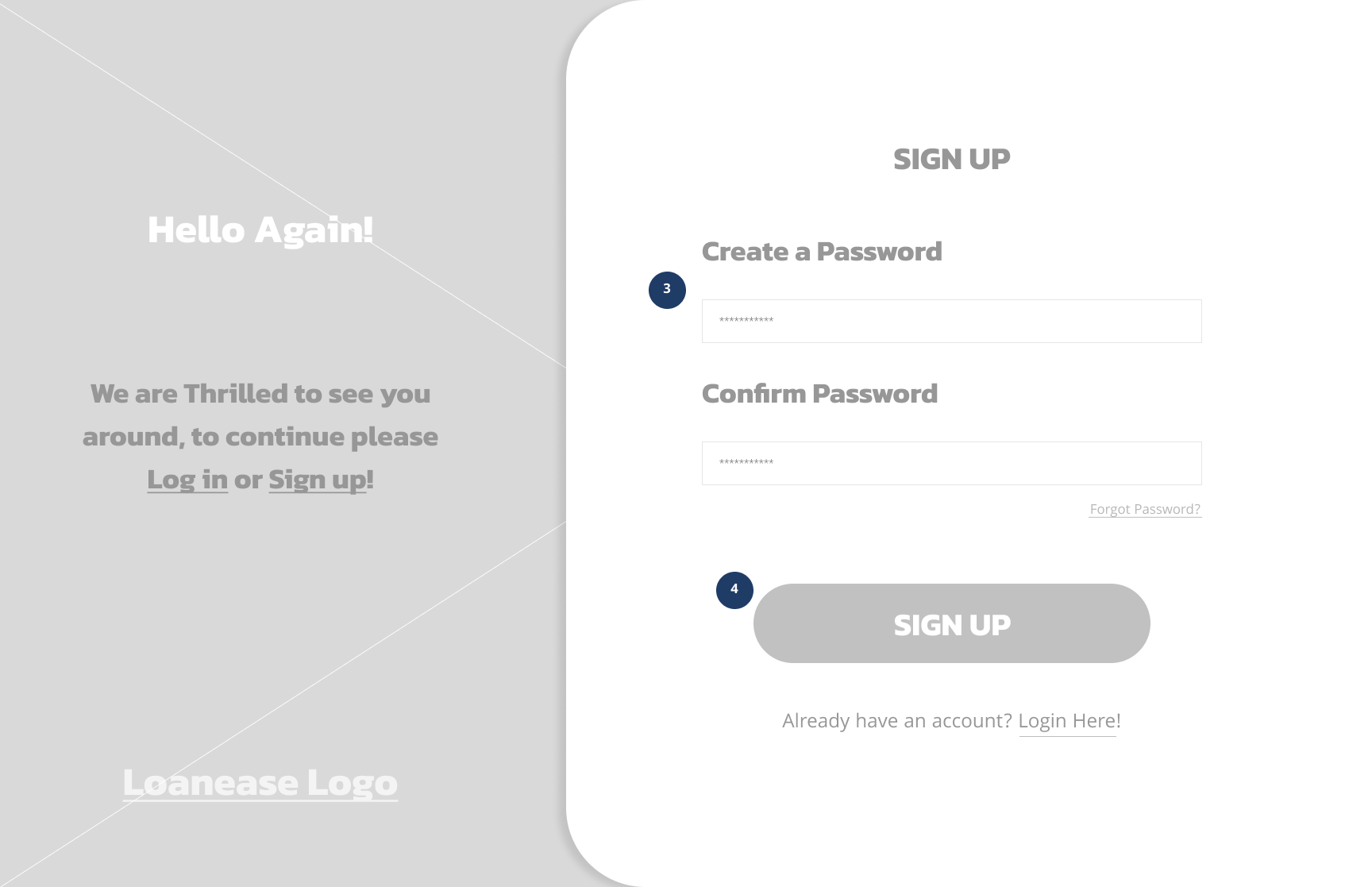

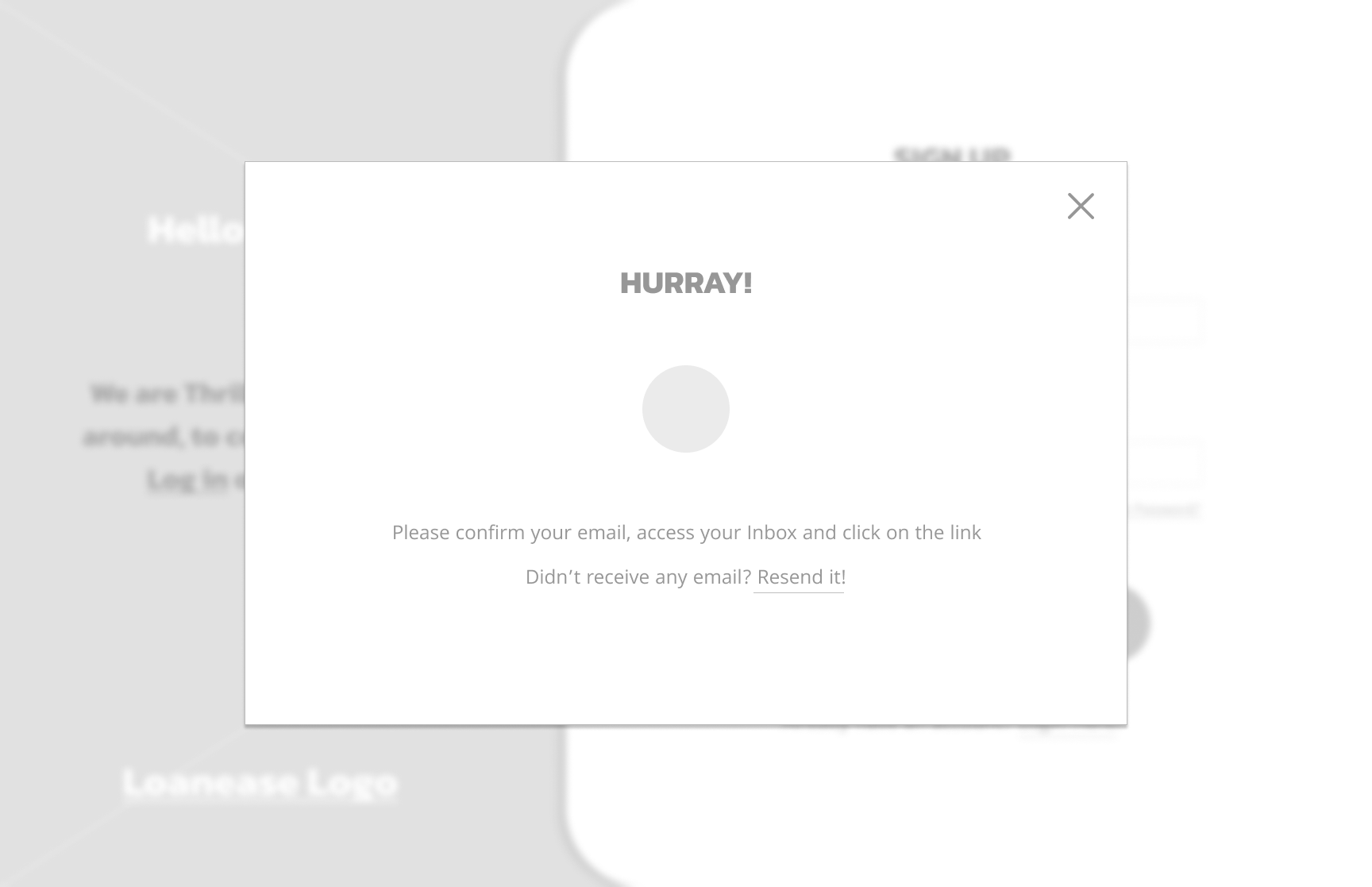

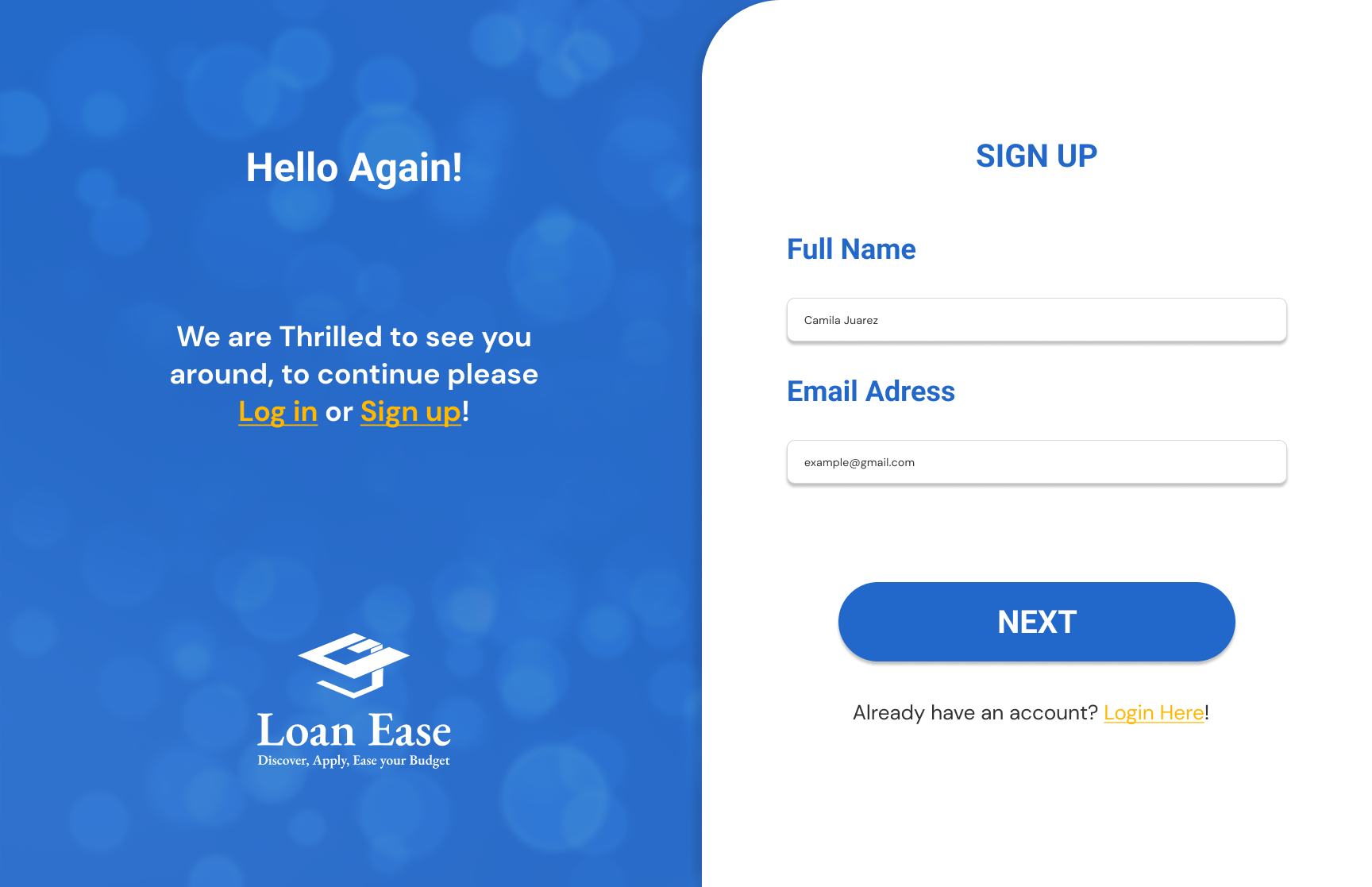

Our design features a minimalistic approach. Based on My Contribution to the project I will show

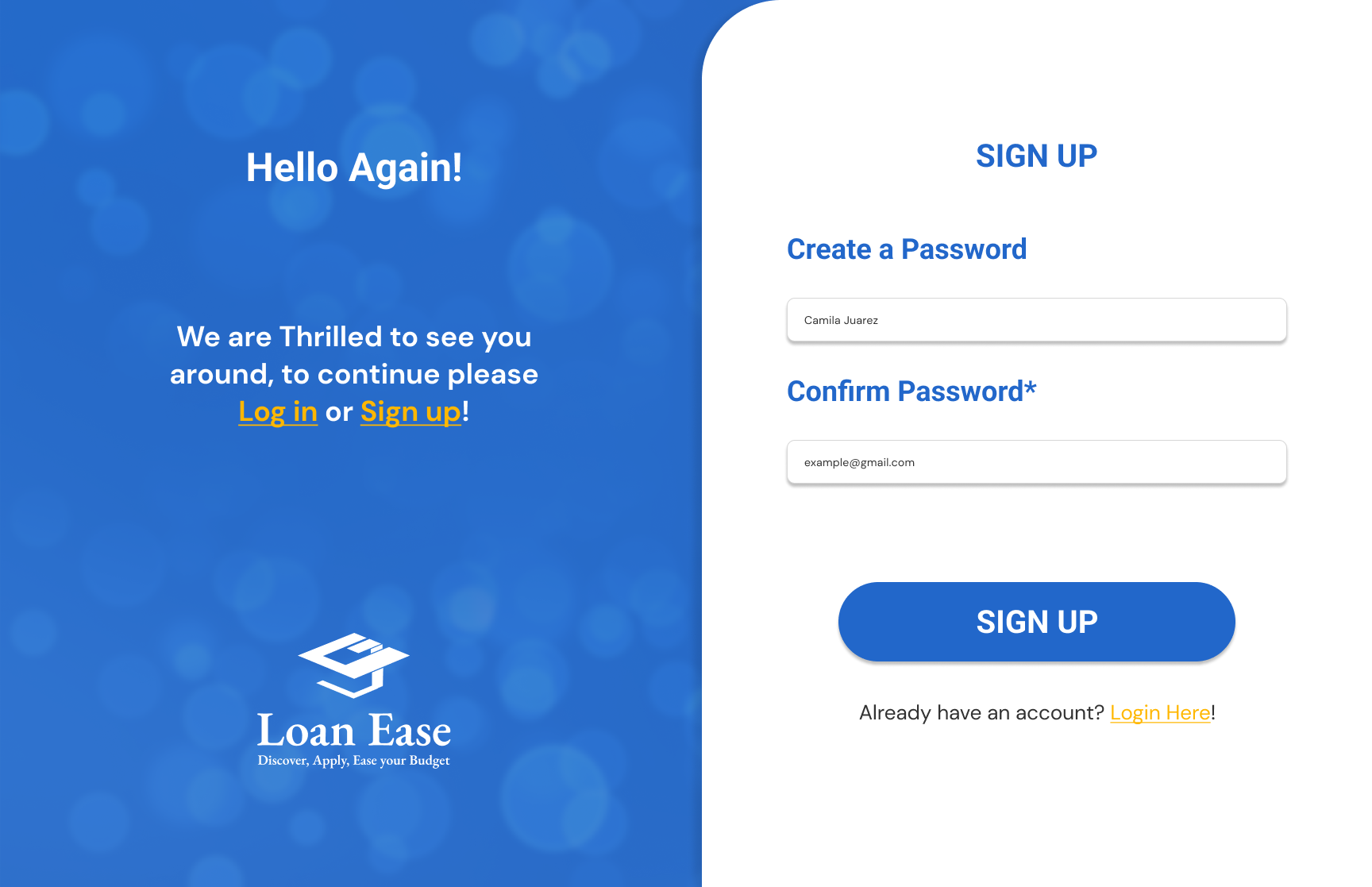

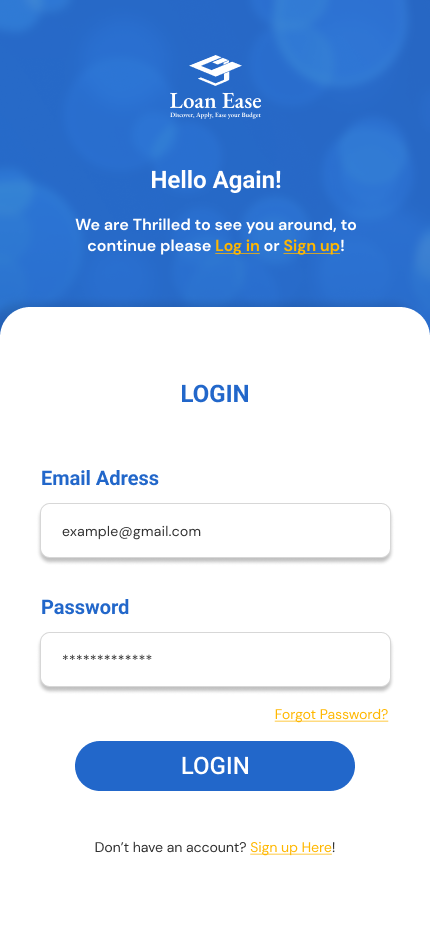

Login

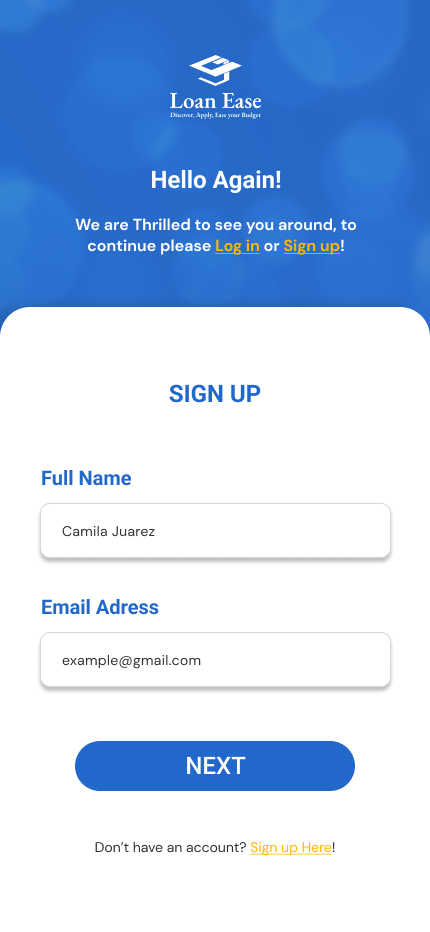

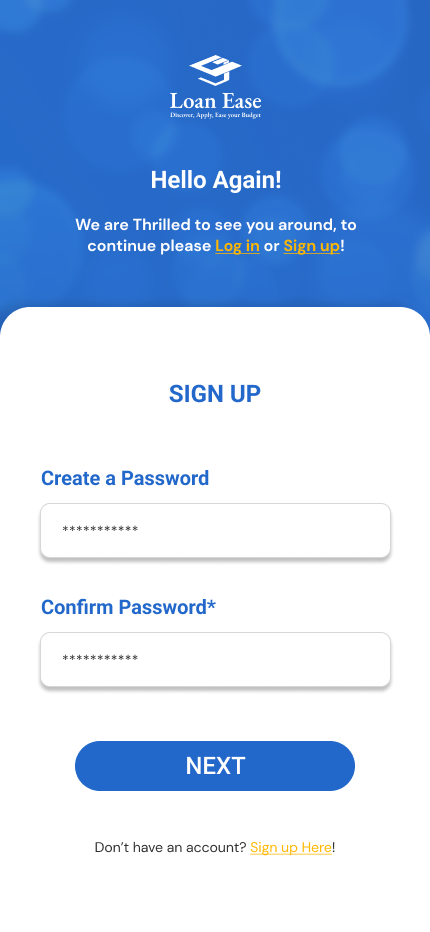

Sign-up

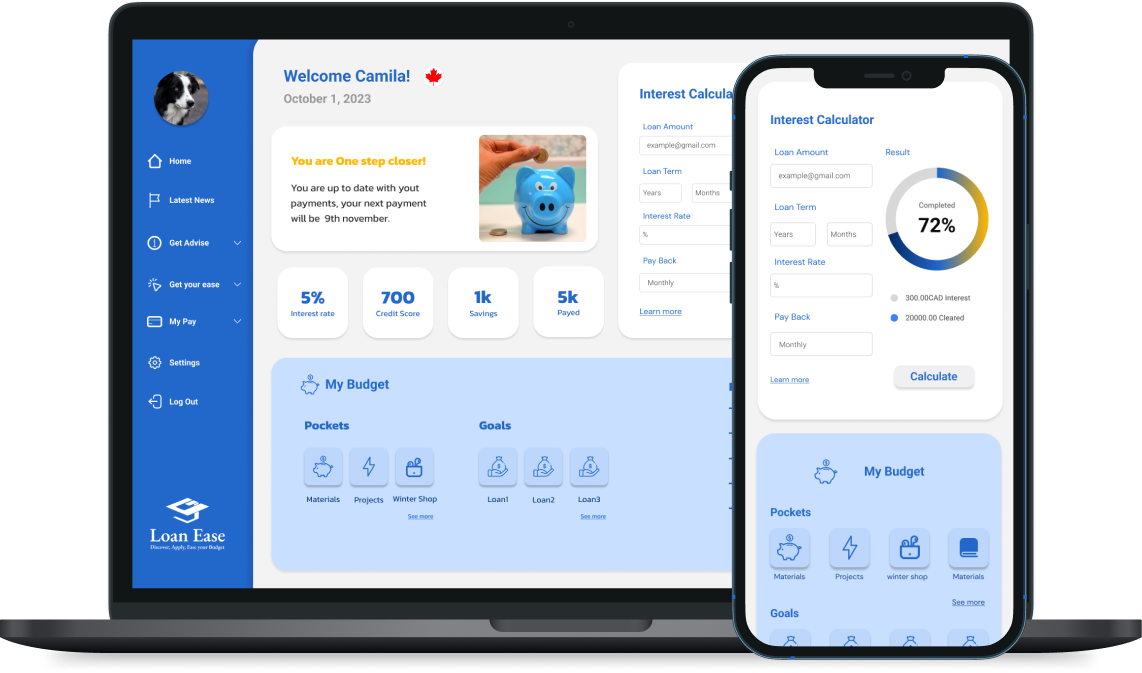

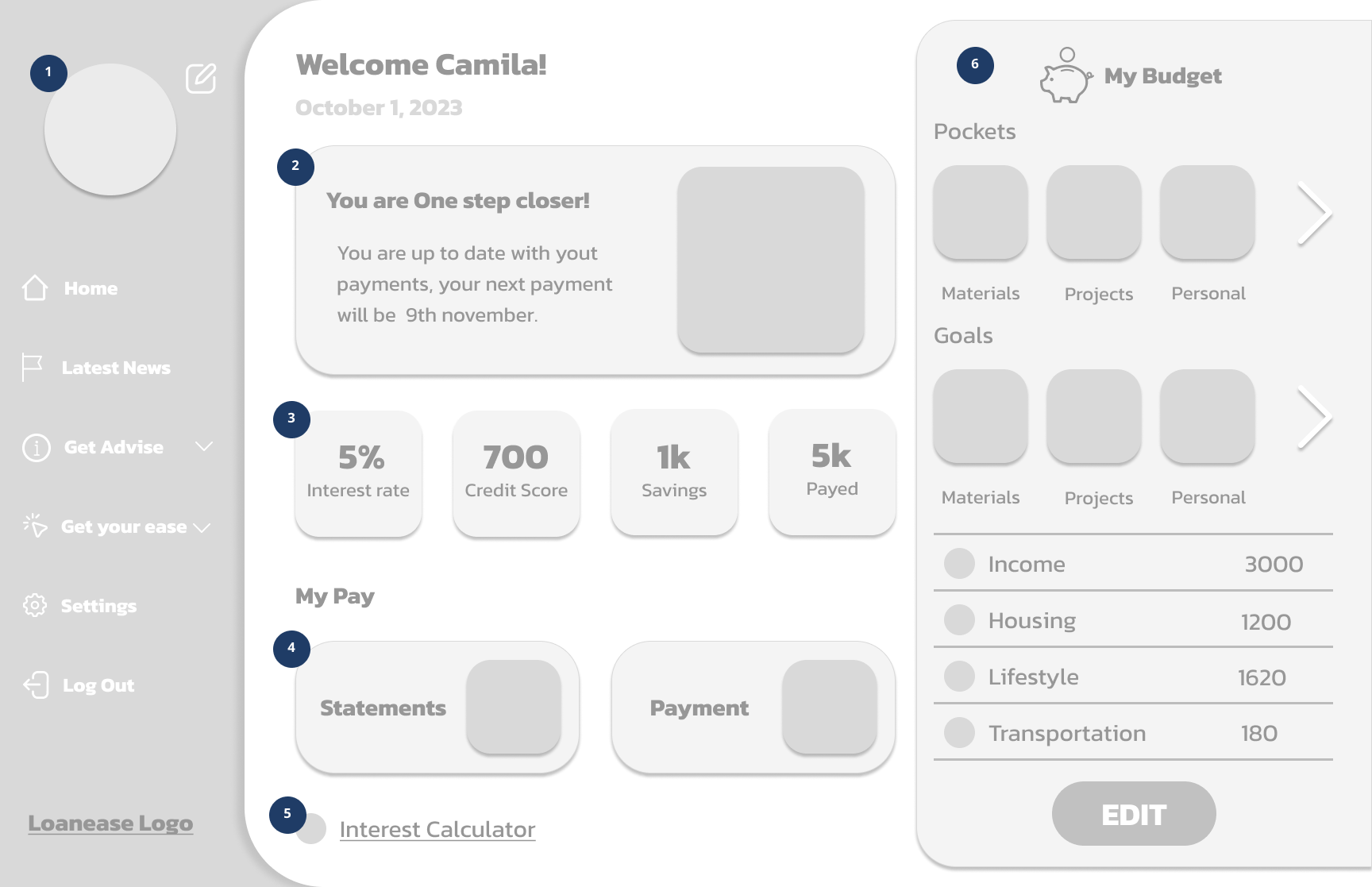

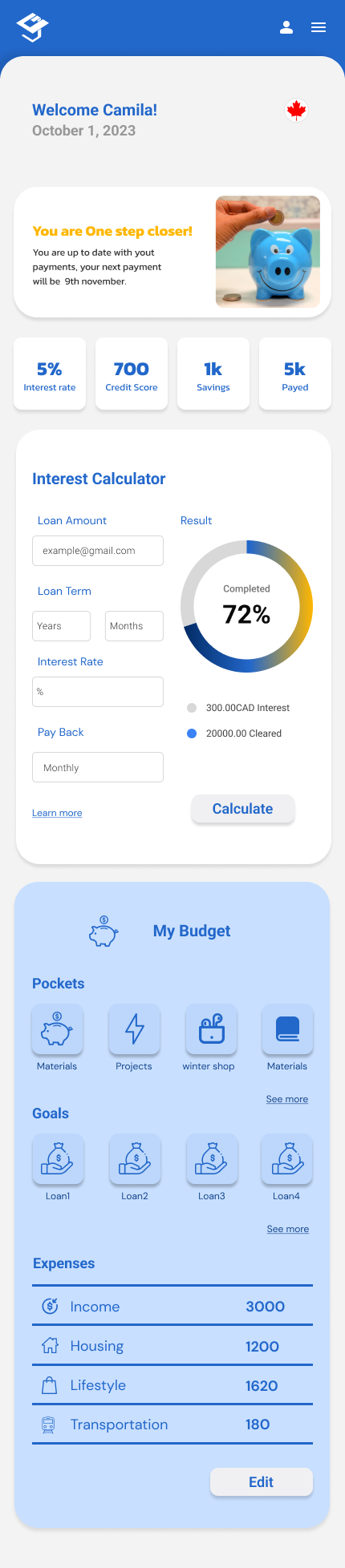

Main Dashboard

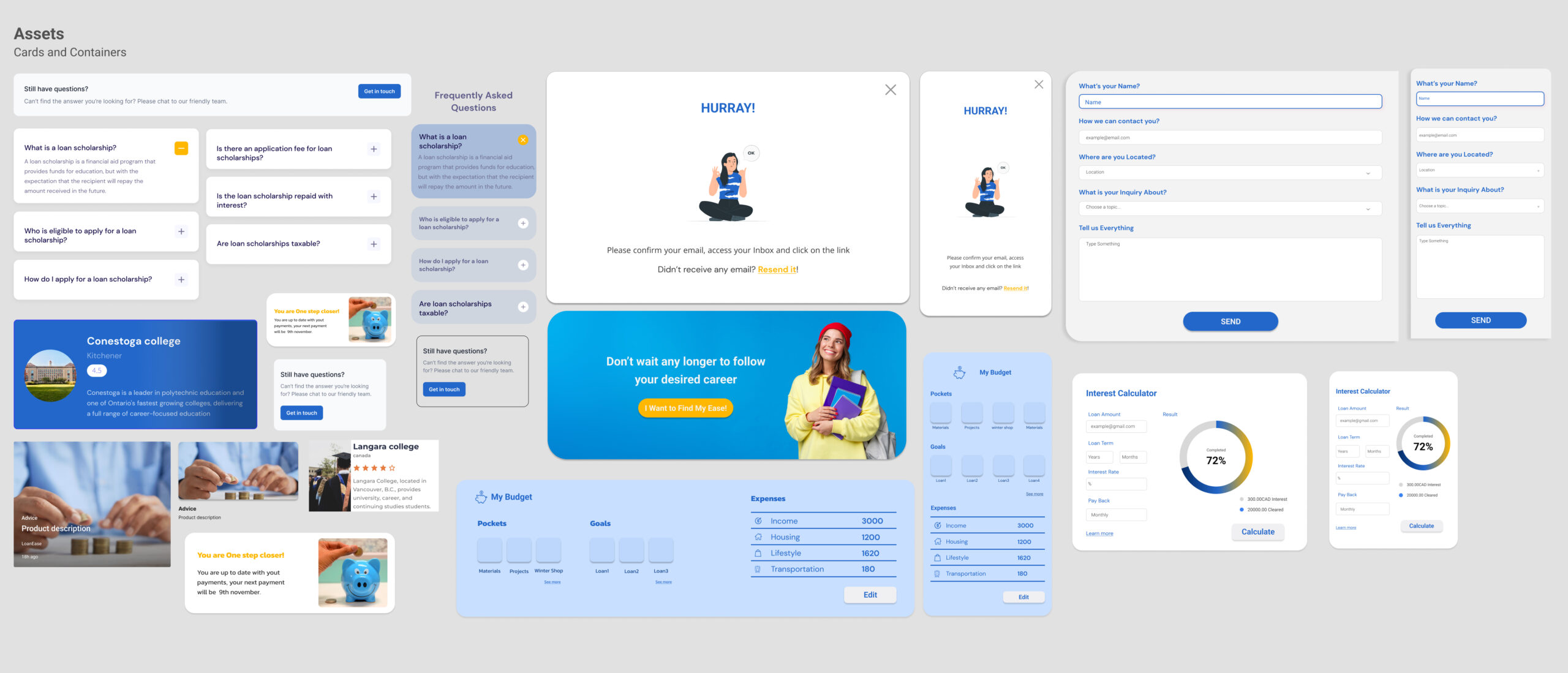

The main dashboard offers a comprehensive overview of key financial metrics, including current loan interest rates, credit score, savings, and loan installment progress. Additionally, our ‘My Budget’ feature empowers users to stay ahead financially by providing personalized budgeting tools.

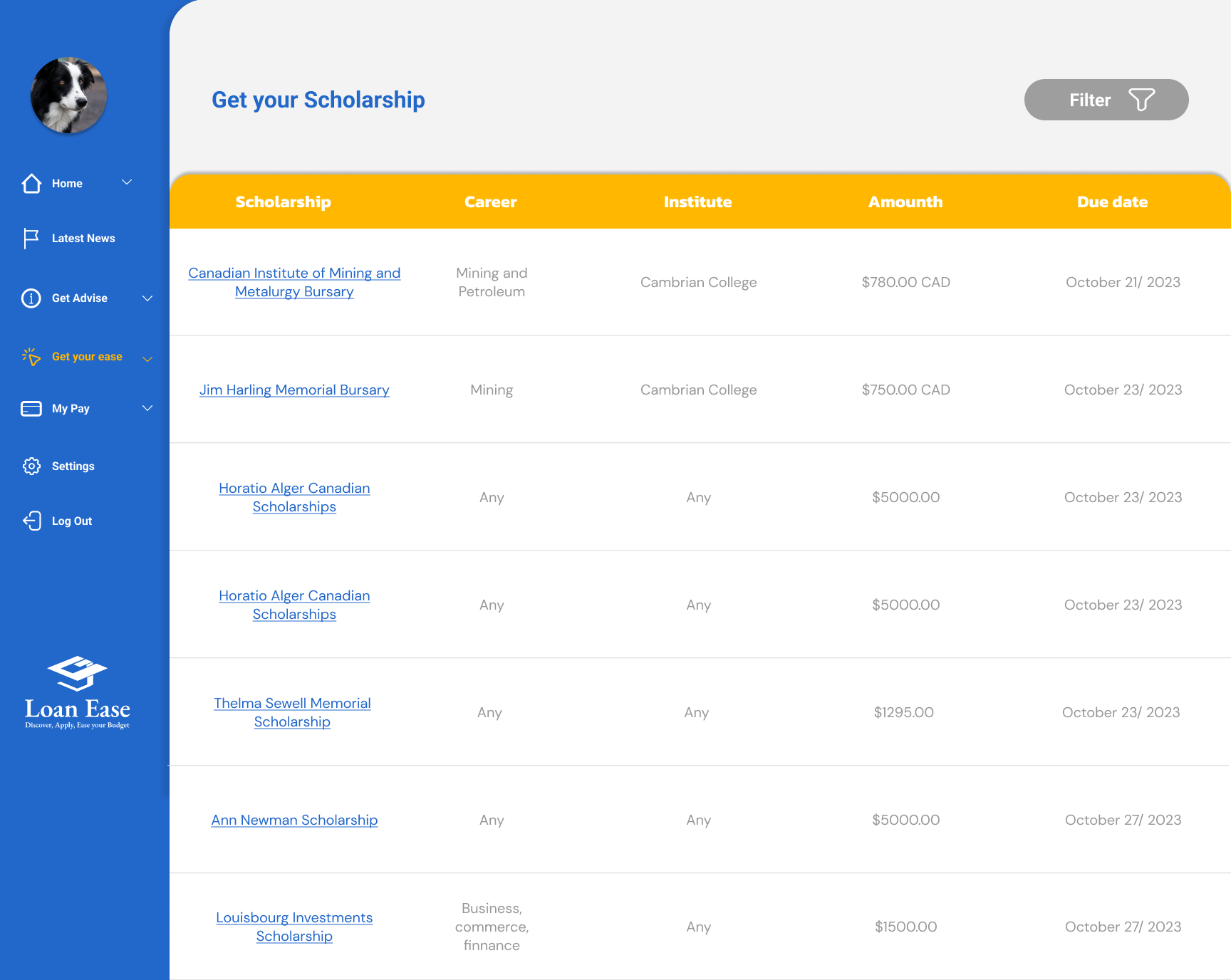

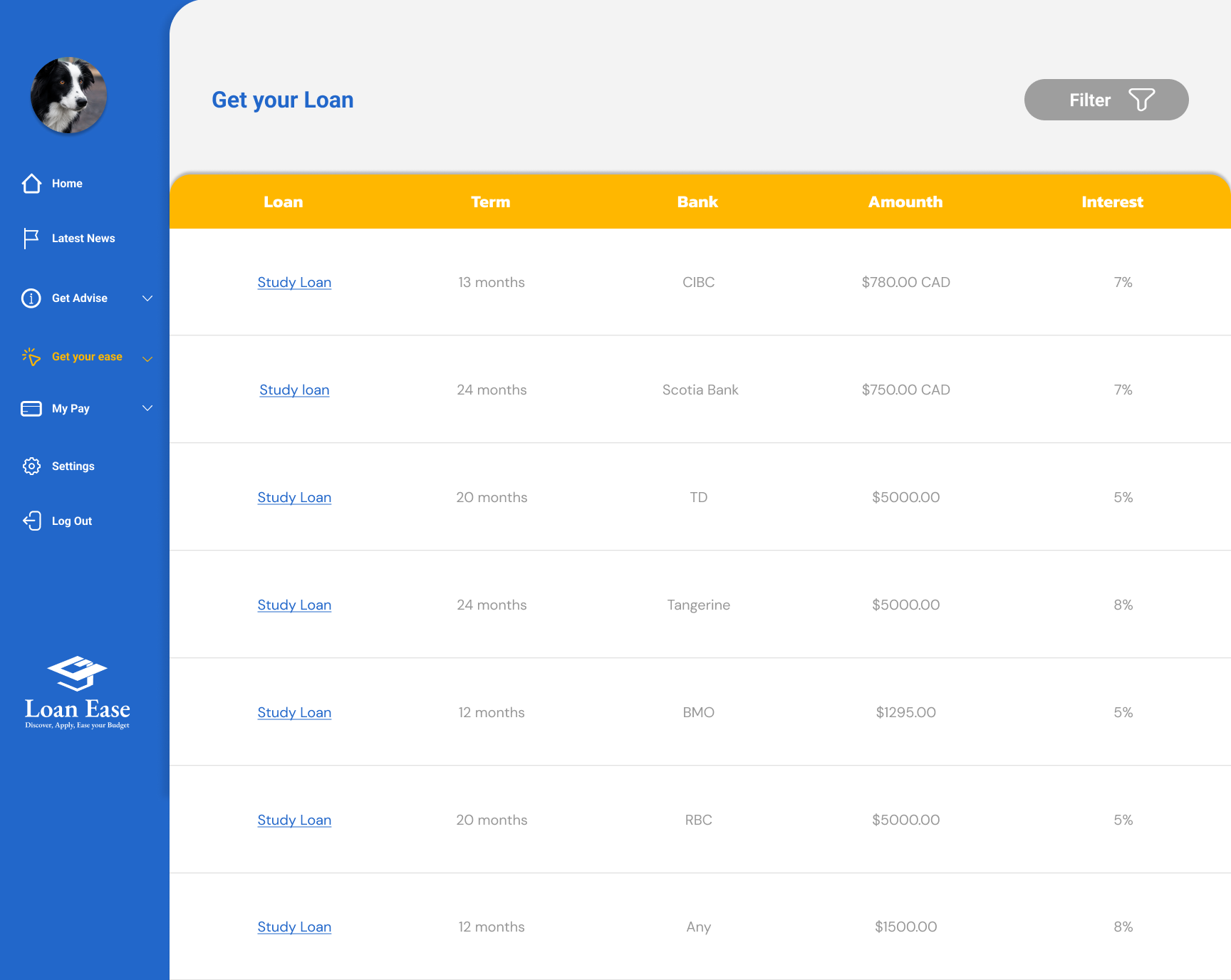

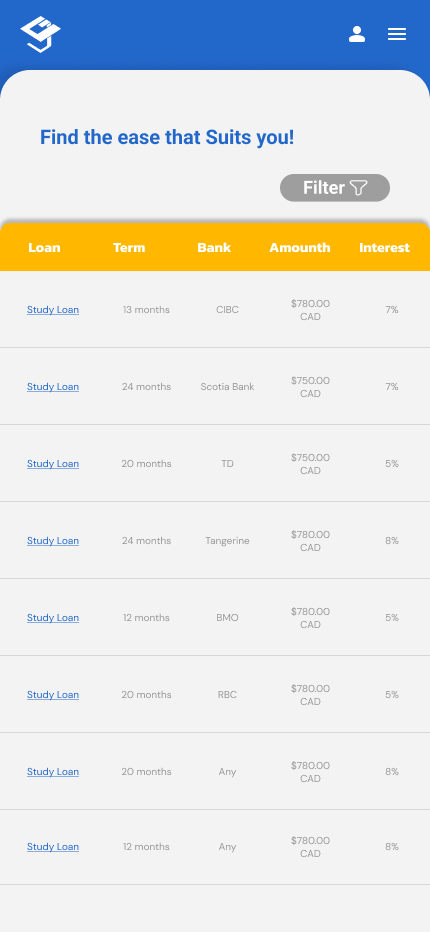

Scholarships and Loan Finder

Find your best option

The Scholarships and Loan Finders allow you to filter your search by loan type, term, bank, amount, due date (for scholarships), and interest rate (for loans), ensuring you find the most relevant financial aid options.

The Scholarships and Loan Finders allow you to filter your search by loan type, term, bank, amount, due date (for scholarships), and interest rate (for loans), ensuring you find the most relevant financial aid options.

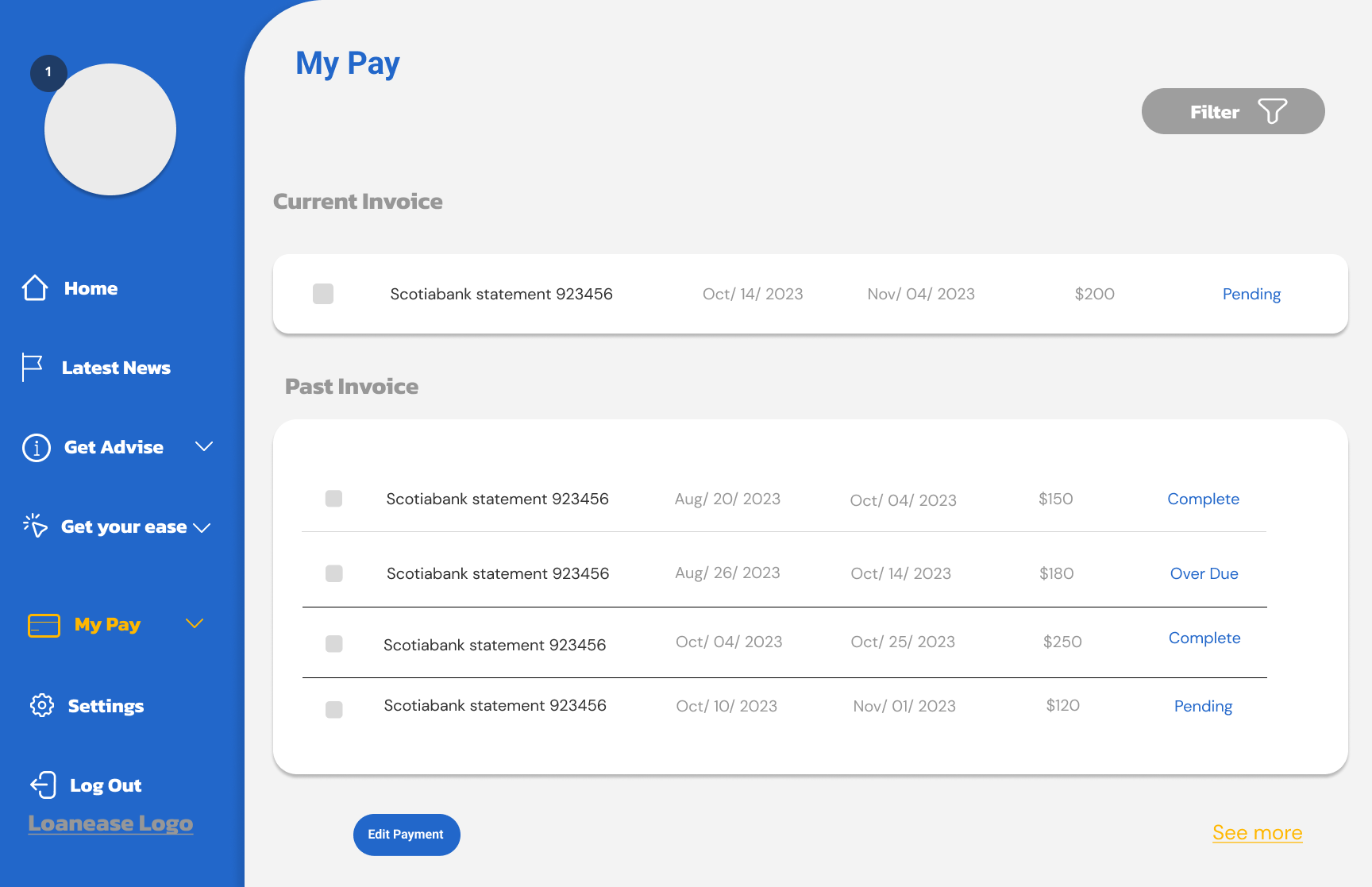

Repayment Feature

– With repayment options, you can receive invoices directly and conveniently pay your loan or scholarship installments in one place.

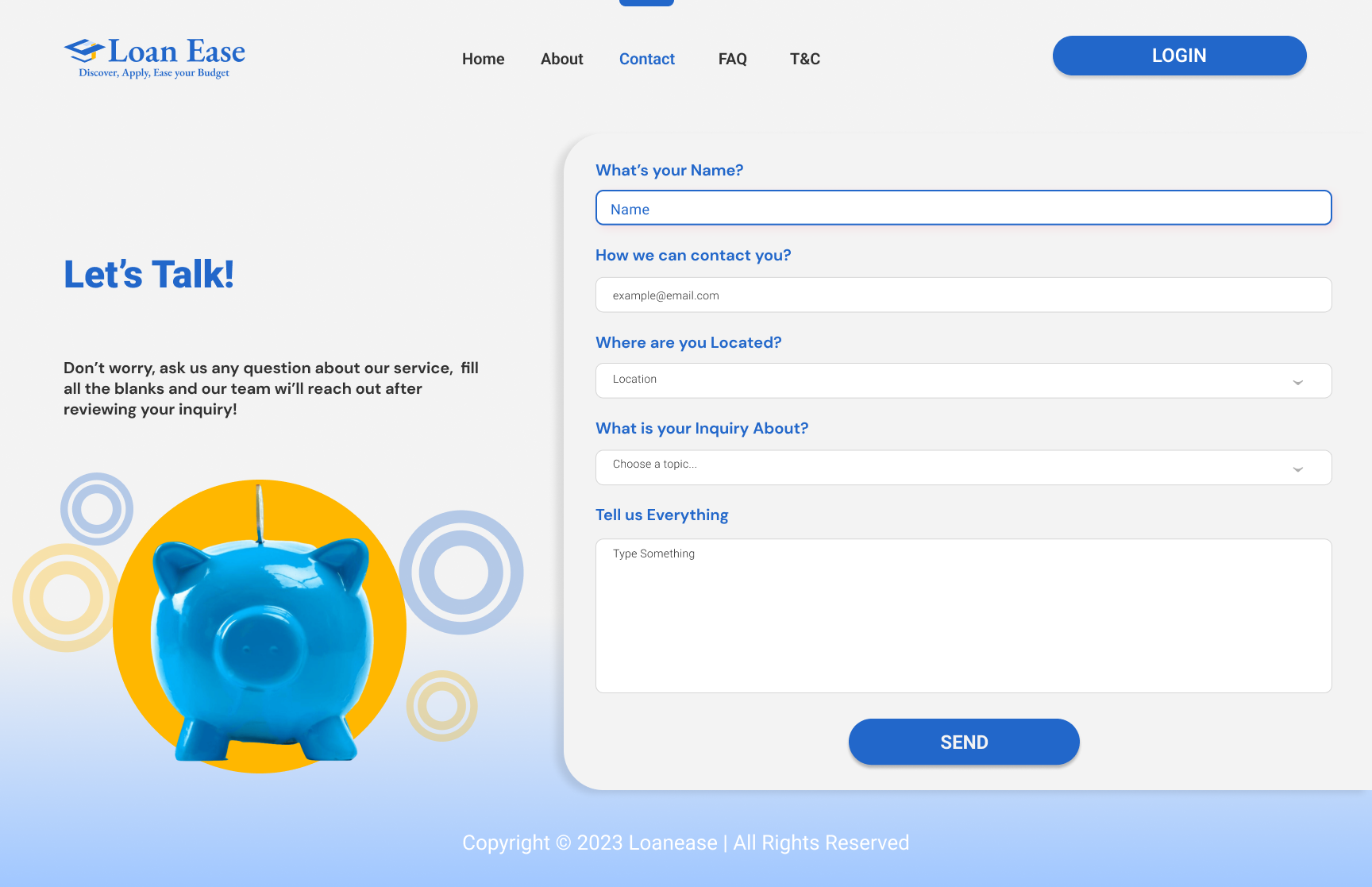

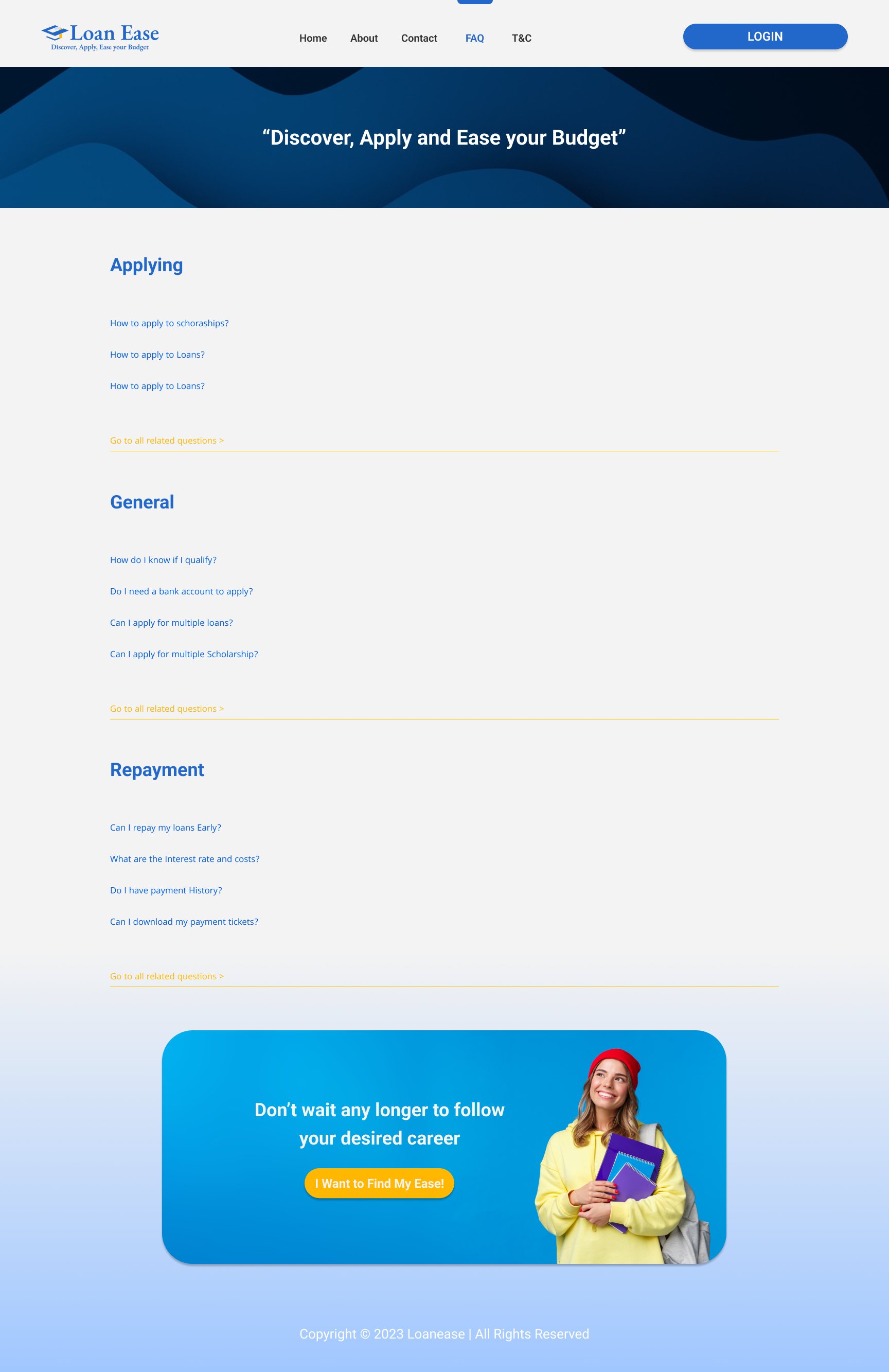

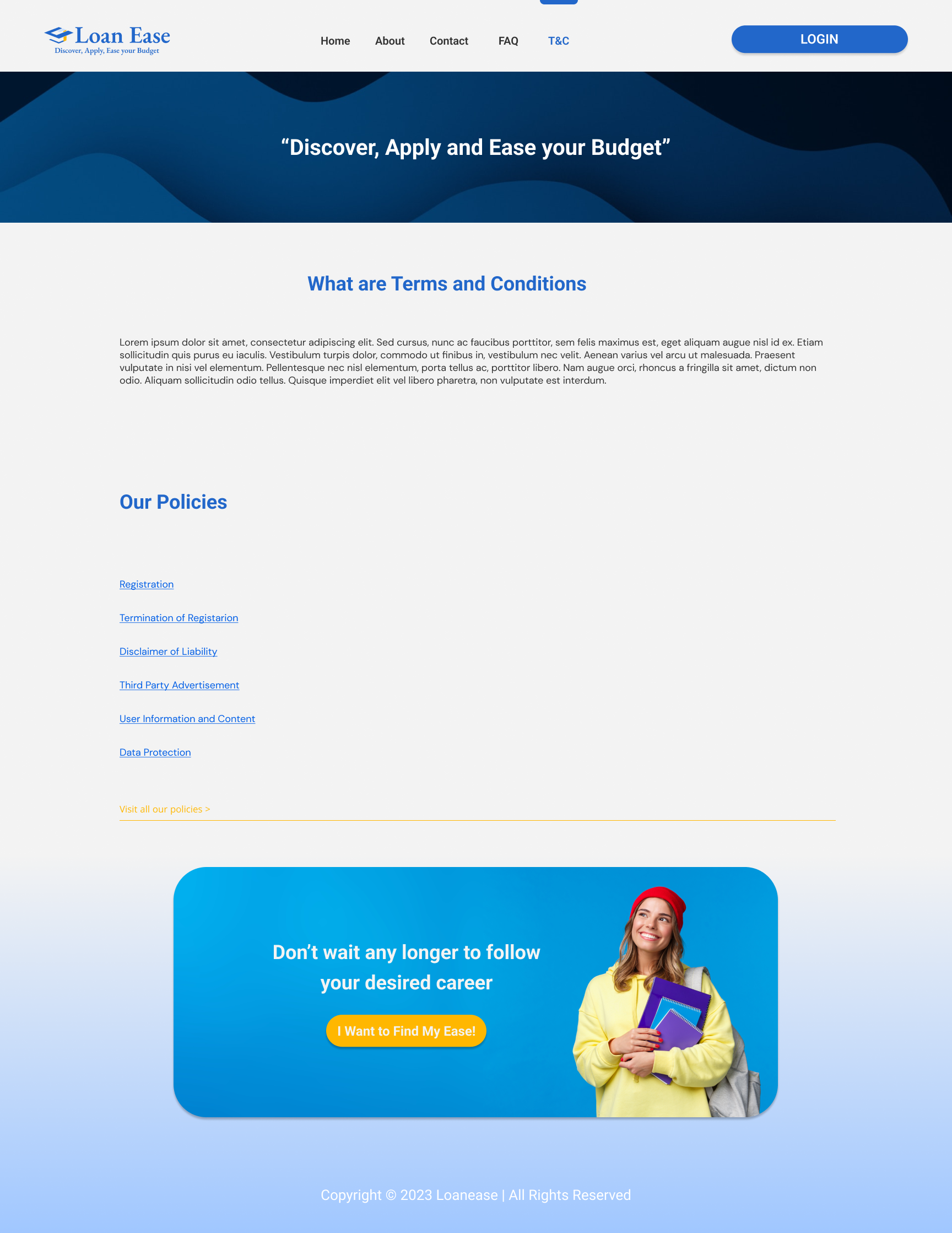

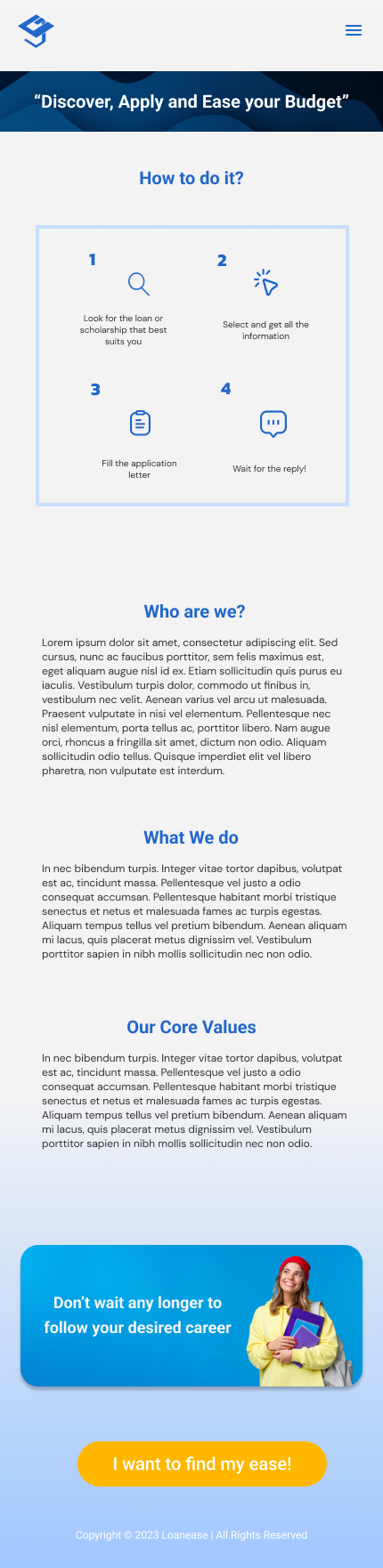

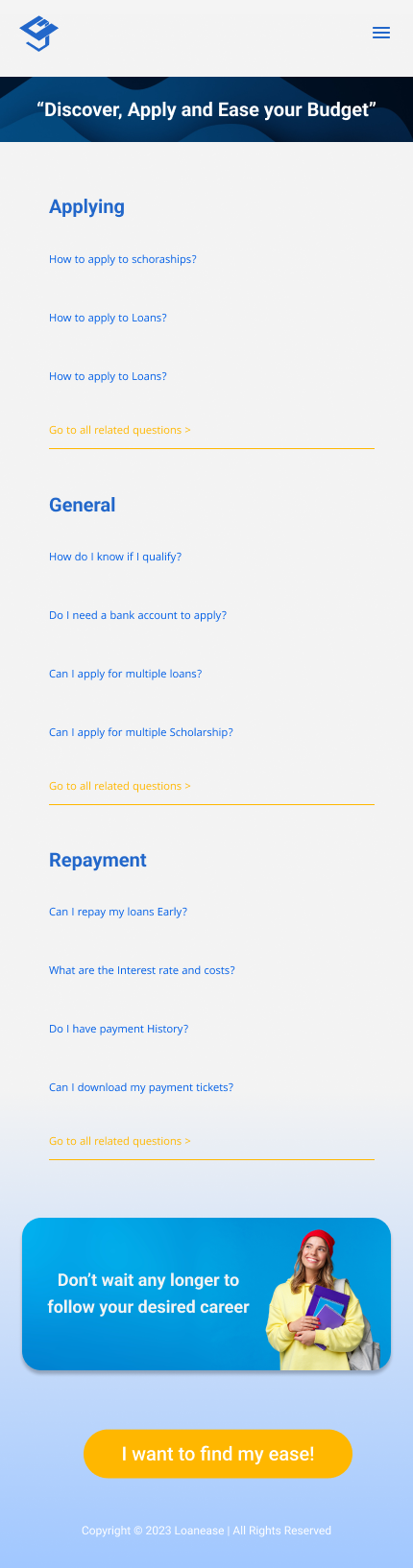

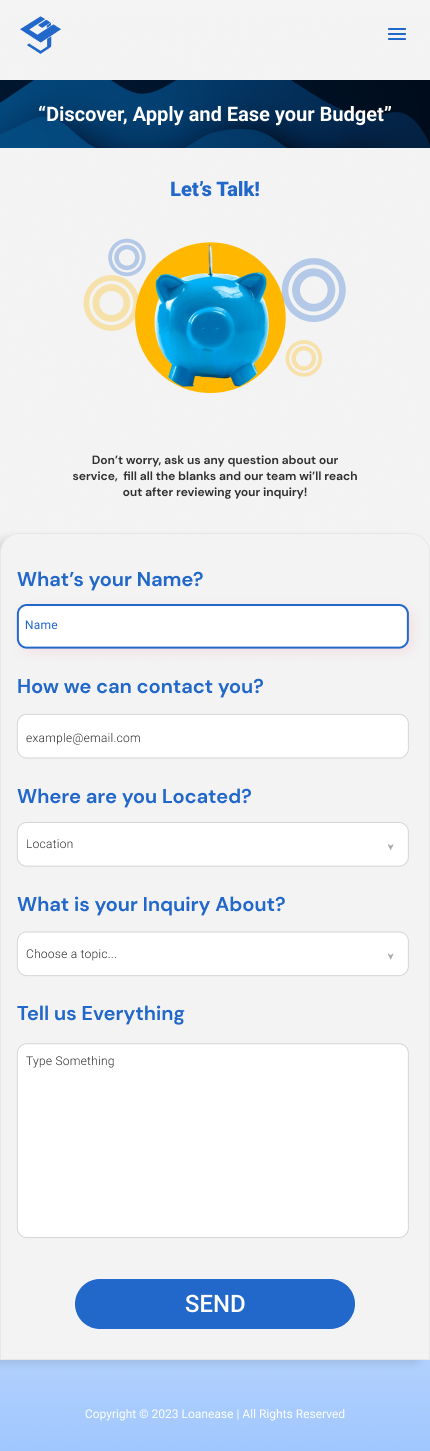

Landing Page

Mobile Mockup

– Refined Responsive Design and final changes added.

Login/ Sign-up

Main Dashboard and Loan/Scholarship finder

Landing Page

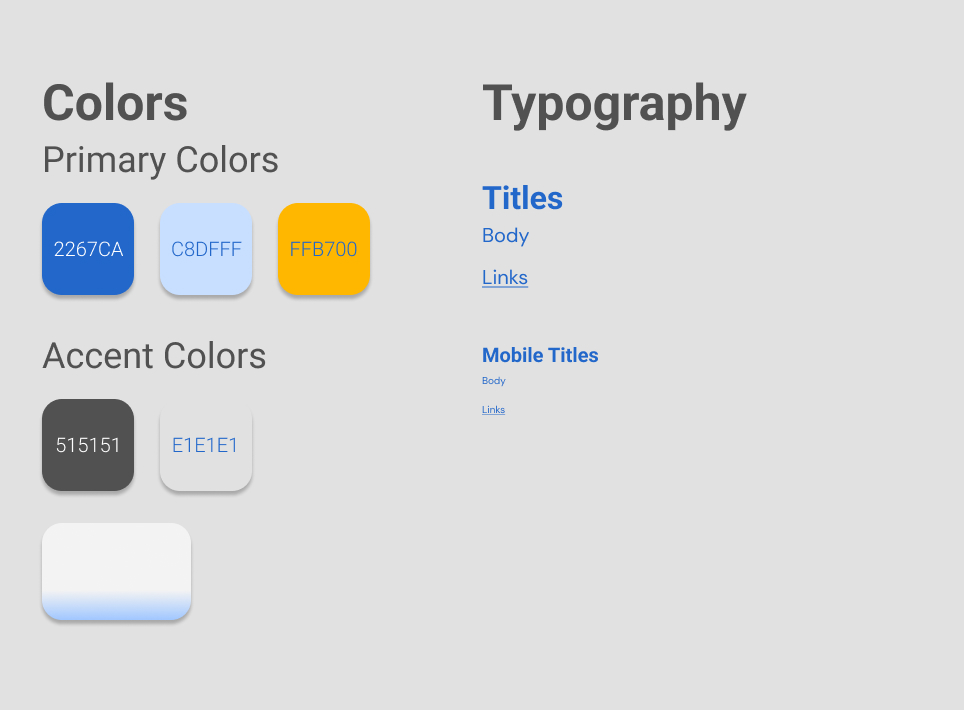

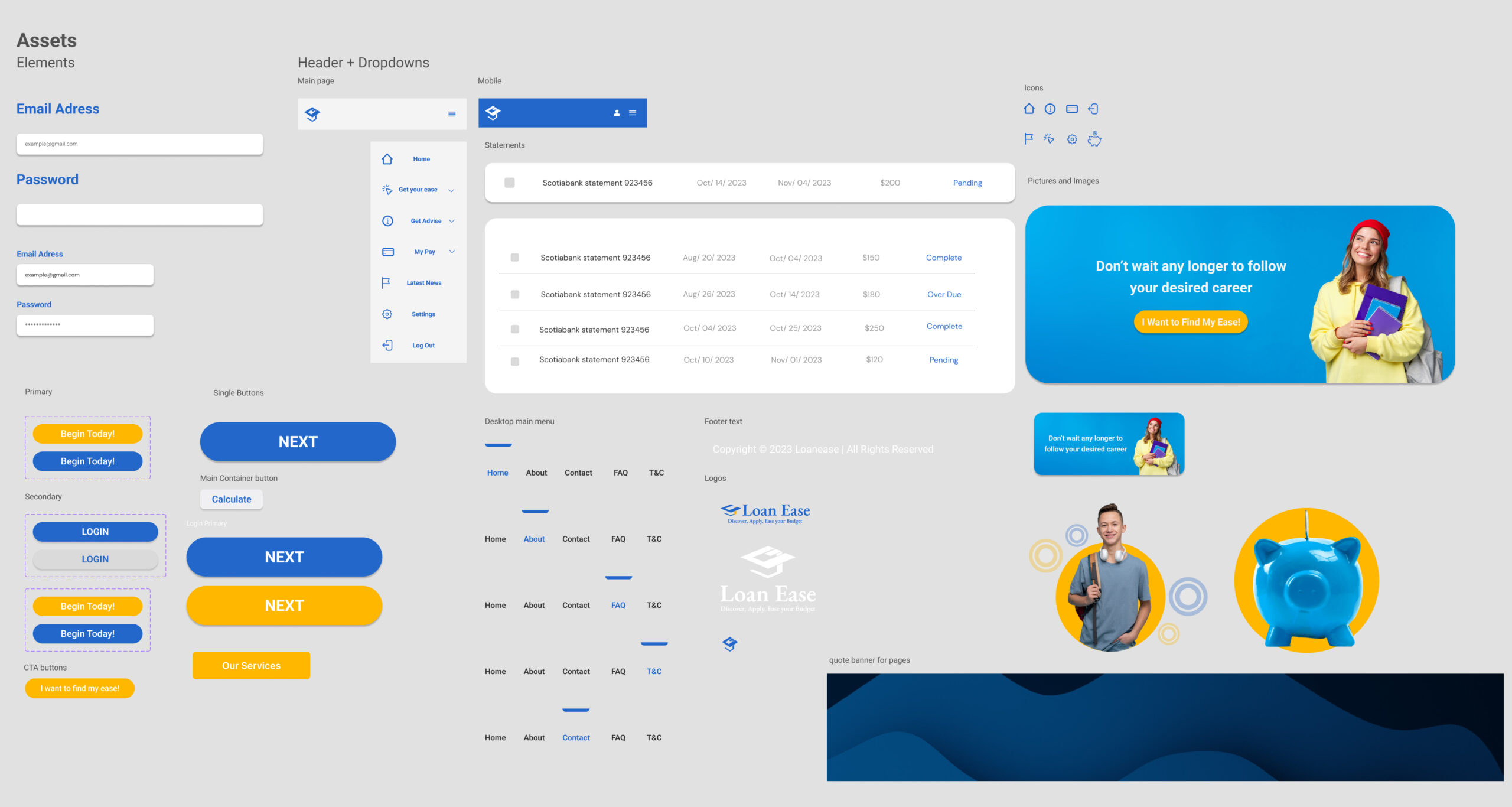

Assets and UI Kit